In February 2018, I attended a presentation in San Juan del Sur on health insurance in Nicaragua.

Presented by insurance agent Leonardo Zamora and organized by Gabriela Castillo at RE/MAX Coastal Properties, the event was an informative source of info for learning about health insurance in Nicaragua.

One of the biggest surprises for me was you need to be under the age of seventy to opt into an insurance plan here. So if you are over that age, you need to find coverage outside of Nicaragua. Oh – and if you’re over forty, you need a medical examination.

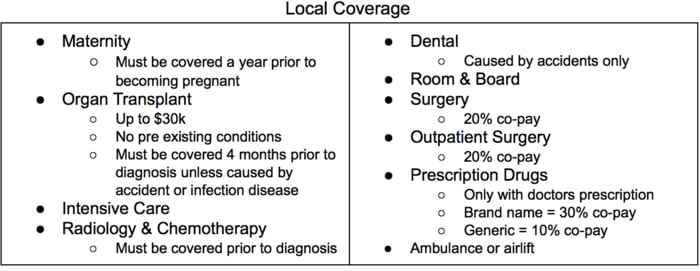

Local Coverage

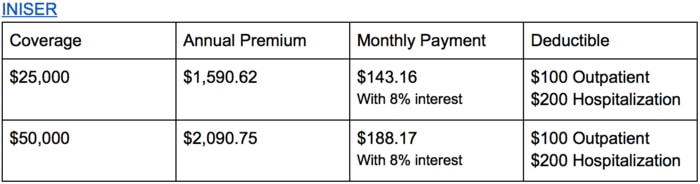

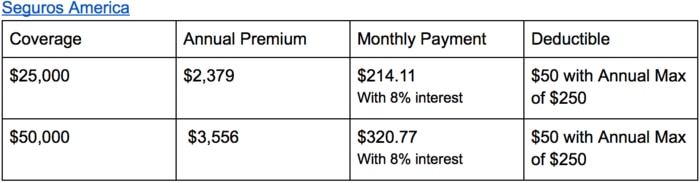

There are five insurance companies in Nicaragua, but only INISER and Seguros America sell individual or family health plans.

The other three companies cover groups of ten or more only.

INISER and Seguros America both have a lifetime cap at $125k with the $25k policy. This means once an insured uses $125k, then the company can no longer cover them. Seguros America raises the cap to $250k with the $50k policy.

The local insurance companies cover what they call a “regional area”. This includes Costa Rica, Honduras, El Salvador, and Guatemala. The other Central American countries, Panama and Belize, are NOT covered.

There are options with INISER and Seguros America to include Panama and Belize and elsewhere, but the premiums are much higher. It’s cheaper to use an international company instead.

INISER has four levels of coverage to choose from: $25k, $50k, $100k, or $125k per insured per year. Seguros America has two: $25k and $50k per insured per year.

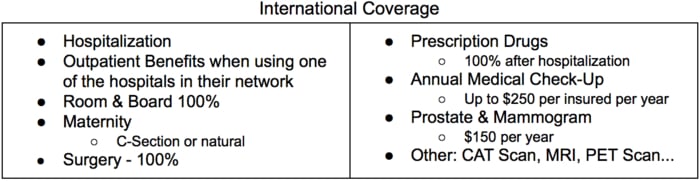

International Coverage

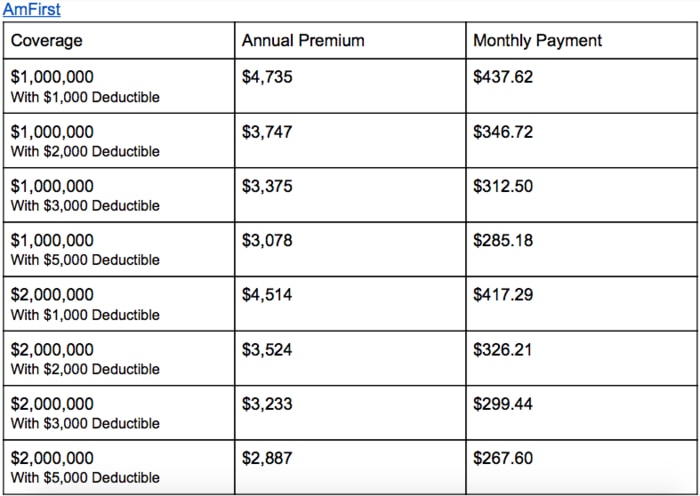

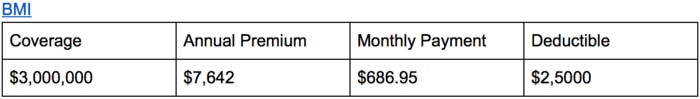

There are two companies who offer international health insurance in Nicaragua, AmFirst and BMI.

Each has a list of international hospitals within their network and there is a $1k deductible waiver when an insured party uses one of these hospitals.

AmFirst has two levels of coverage, $2M and $5M per insured per year. While there are no pre-existing conditions allowed, they offer a separate plan program for these. BMI has three levels of coverage, $3M, $5M, and $10M per insured per year.

It’s worth pointing out neither of the two best hospitals in Nicaragua – Vivian Pellas and the Military Hospital – are in their networks and so don’t qualify for the $1k deductible waiver.

Insurance Quotes

I asked the presenting insurance agent to give me some quotes for my family of four.

Each family member has a separate annual fee and this is added together for a family total. You never need to pay for over three kids and there is a $150 reduction for spouses. Our ages are forty, thirty-nine, six, and three:

After crunching these numbers I thought about my family’s personal emergency needs.

We’ve had two emergencies since moving to Nicaragua in 2015.

The first was when my daughter sliced off the pad of her finger in a snow cone machine. We got adequate care using Nicaragua’s free healthcare at the local hospital.

The second incident was when my husband cut the knuckle of his thumb with a machete.

The free hospital did a horrible job, and he ended up having surgery at Vivian Pellas in Managua, costing around $3,000.

In theory, it would have cost us less to pay for local insurance even if we had been paying for three years before this incident. I say “in theory” because it’s possible the surgeon wouldn’t have been covered, or there might have been an extra charge for his specialization.

Hospital Vivian Pellas also offers insurance through their Healthcare Club, but again, there’s a possibility your doctor isn’t covered.

The other medical concern I have is when we travel to the USA.

I always fear that on our trips home one of us will get sick or hurt enough to need hospital care, but I’ve never wanted to pay for annual international insurance to cover us during these short trips.

I looked into travel insurance, and there are only a few options for US expats looking for coverage while visiting the States.

The best option for us is a $500k policy with a $500 deductible plus 20 percent of the first $5k. This costs $245.52 for a month with Seven Corners.

For more info on health insurance in Nicaragua, contact Leonardo Zamora ljzamora@ljzseguros.com.

Jenna Reid moved to San Juan del Sur, Nicaragua with her husband and two kids in 2015. She helps her husband operate a website development company and she enjoys freelance writing. Her personal blog is The 1 Less Traveled By.